Future of Data Sharing

Reimagining Design for Fintech

Duration: 2 Weeks

Project Info: A remote design jam (hackathon) by D91 Labs around data sharing through Account Aggregators . It was sponsored by Facebook and partnership with Sahamati, Parallel Labs, Digital India Collective for Empowerment and CIIE.CO.

My Role: UX Research, Sketching & WireFraming, Presentation

The Design Jam's Objective

‘How might we design a trustworthy UX for an individual to share data using AA?’

Overview

During the past few years data has become a prominent part of both personal and business usages. Organizations and businesses are leveraging the power of data to enhance their products or services according to their customer needs. But to protect the user's data from being misused, the Personal Data Protection bill 2019, define the rights individuals have over their personal data and the responsibilities of entities accessing user data.

The two-week Design Jam is a part of a research study by D91 Labs to understand the challenges and opportunities in designing financial products under the new regulatory frameworks of Account Aggregators and PDP bill.

We were among the 9 teams who participated in a design jam. The team were consisting of designers, product managers, founders, policy experts and facilitators. During these two weeks, we got the opportunity to understand the financial infrastructure of India. We studied how the new Account Aggregator concept will redefine data sharing in fintech products. We got to chance to get interact with experts from different sectors along with the mentorship/reviewing session by Kishore Kumar from Google Pay on designing UX of the financial apps and by Anand Krishnan from Data Security Policy of India.

The Problem:

The Account Aggregator (AA) framework is the new territory for the consent-based data sharing system. It is built as a digital public infrastructure that allows individual to share their own financial data from one party to the other with their consent. Each team was given a person and a fintech use case like lending, expense management or portfolio management.

Our persona was Raghu who was a survivor with basic tech literacy. We needed to design and integrate the AA framework in a personal loan application use case Instamoney. Our goal was to redesign the app with the AA framework and build user trust and for informed consent.

Proposed Solution:

We redesign the Instamoney application keeping in mind our persona characteristics and needs. Our design was focus on bettering the onboarding process to build trust around the safety of AA. We used universal navigation to track the loan application progress and integrated contextual video tutorials to educate the user about the AA. We aimed to provide fast and hassle-free access to a personal loan by sharing financial data securely and independently.

How can we reimagine data sharing in financial services using Account Aggregators while instilling trust and confidence in a new and secure way of sharing financial data?

01

Problem Background

User shares their personal financial data with the financial institution for lending, expense management, portfolio management, etc on regular basis. The Account Aggregator framework is proposed to securely share the financial data and to unlock deep value for all participants in the ecosystem. For users sharing their financial data with AA holds the promise of better borrowing terms, particularly for the new to credit borrower segments; banks and lenders gain access to rich data for underwriting loans and monitoring the borrower’s financial health; all of this enabled through a thriving ecosystem of technical service providers, consent managers, and customer-facing apps.

The AA focused on a consent-based data sharing system to honour the spirit of personal data protection. But in a country like India where the majority of the population is less tech-savvy and rely on their friends and family to make the financial decision, making them understand the concept of the AA and gaining their trust will either make or break the AA framework.

These challenges form our core research agenda:

-

Designing for user trust

-

Designing for informed consent

Project Timeline

01

Empathize

02

Research

03

Ideation, Design

04

Prototype,

Concept Presentation

Understanding Account Aggregator

The Account Aggregator (AA) framework is the application for unlocking value from personal data. The AA framework creates a well-defined and secure mode for users to share their personal financial data with other eligible entities. It works on the concept of a robust consent-based data sharing system where they can pick and choose what type of data they can share and what entities can access them. Account Aggregators (AA) is built as a digital public infrastructure that allows individuals to share their own financial data from one party to the other with their consent.

Under the AA framework, data sharing is enabled by three main entities:

-

Financial information provider (FIP): Entity that holds your data (Banks, Income tax department, GST, AMCs etc)

-

Financial information user (FIU): Organisation that requests your data (Fintech app, digital lender etc)

-

Account Aggregator (AA): An RBI licensed entity that enables this data sharing (Mostly an app or a website)

Fictional Product and Persona Background

Our Design Jam Goal

Design new user workflows for Instamoney using the Account Aggregator to address the pain points of both the user and the businesses.

Our team’s fictional product was Instamoney which is a lends personal loan up to 5 lakhs to users.

We understood the current flow of the application and noted down business and user pain points:

User pain points:

1. Long forms are time-consuming and leads to frustration and drop-offs.

2. Not everyone has internet banking.

3. Getting hard copies from banks is a pain.

Business pain points:

1. Manually entered personal information cannot be verified.

2. PDFs often have parsing errors.

Our Persona

Defining a Challenge Statement

To define clear objectives, we started with generating HMW questions related to our persona and the Instamoney app existing workflow. We outline and pointed out how AA integration is going to help our persona. This helped us in narrowing down our focus to one use case that helped us define our design challenge statement.

Design an onboarding process for personal lending to build trust around the safety of AA and educate users on the benefits of using it to share data so that they can independently have fast and hassle-free access to loans.

User Journey Map

We identified forward steps in the user journey if AA is integrated based on the challenge statement. During this step, we had multiple questions that we tried to unfold like: Can KYC be connected with AA? Can AA see the data? What all data can AA collect through FIP? can FIU manipulate data from AA? will they collect data even if the account is inactive? and many more. We refer back to the AA resources and understand the capabilities and limitations of AA. We tried to clarify as much as possible regarding the working and concept of AA.

Finding new problem new User Journey Map

We looked at the new customer journey map through the lens of our persona and identified their thoughts, fear, and needs. It helped us empathize with our persona more based on the new journey flow.

The next step was to understand these new problems in the flow and ideate for these problems around account aggregator integration.

Ideation

Our workflow can be divided into three major tasks:

1. To educate Raghu about Account Aggregator

2. To build Raghu's trust while sharing details via Account Aggregator

3. To give Raghu confidence that his data has been safely shared with Instamoney with his consent.

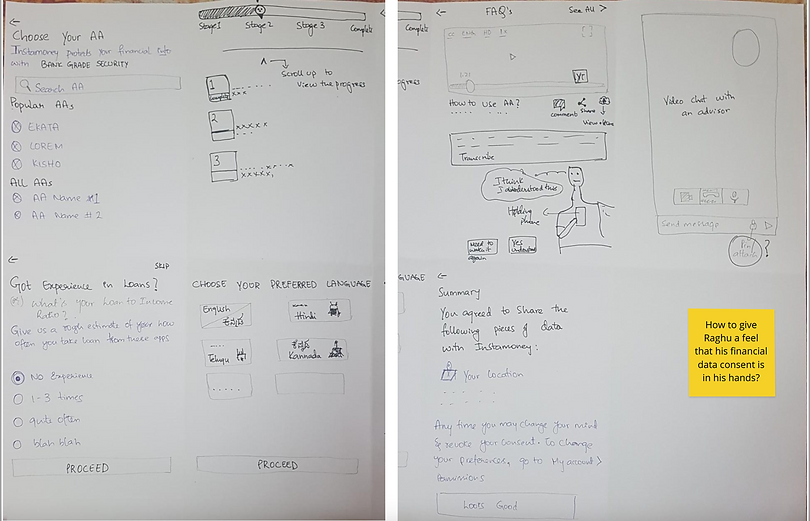

Initial Idea Sketching & Main Pain Point

Idea Voting and concept storyboarding

We used heat map voting to select ideas and discuss them briefly. These ideas were then put into the storyboard to finalise the final flow of sketches that addresses our design challenge.

This storyboard was our first reference point to see our new customer flow with our ideas into the visual form. While building the sketches into hi-fidelity form, we went through multiple iteration stages based on the feedback and review from our facilitator Parth and design mentoring session.

Final Design

Feature #1

Clear step by step process

-

Giving process steps information at the start and providing knowledge on why and how user data will be used at each step.

-

This makes the process more transparent. Users are informed about how their data sharing is going to help them during the process so that they’re comfortable with sharing them.

Feature #2

Preventing errors & forgiving them

-

Making errors is an integral part of the way we humans live. Our persona Raghu is less tech-savvy and is afraid of making mistakes.

-

Hence, having an easy option to go back and change details every time helps users to be more independent and less confused while navigating to fix errors/mistakes made during filling out details.

Feature #3

Building trust to share via Account Aggregator

-

We included a contextual video on the use of the AA to explain it in detail.

-

We added the time taken to share the details through AA to convey the easiness of it over the manually uploaded documents.

-

We used the text “ “Approved by RBI” to show the authenticity and credibility of the process.

Feature #4

Proof of documents shared in visual form

-

Since AA acts as a data locker and asks for consent to share the data with FIU without actually showing the documents. People similar to our persona- Raghu who have more experience in dealing with hard copies over soft copies might have a concern if their data got shared with the third-party app. Giving them an option to view what they shared increases their control over the process and crosscheck the documents they shared with the application.

Feature #5

Support System with voice message feature

-

Along with selecting the concern from the list and typing the query in the message box at the bottom. Users sometimes fail to ask the write question through text. We added a voice feature to make it easier to convey their problem and wait for support to reply.

-

Also, we kept our support gender-neutral based on the insight that most of the Indian Banks who used female gender for their support bot received abuse messages from their users, which forced them to reconsider the name and personality of their support bot.

Key learnings from Policy & Design Mentoring

As mentioned earlier, during the design jam challenge, we had a mentoring session with designer Kishore Kumar from Google Pay and policy manager Anand Krishnan from the Data Security Council of India.

Both the sessions were centred around designing for data in the fintech products in the Indian context.

Design mentoring helped us in redesigning our login page and language selection option. Policy mentoring guided us about how we can put the elements in the way our persona relates. Also, we tried to simplify the information in a way that the user understands and is not intimidated by the process.

We came across this idea of how to incorporate fine print more effectively in an app.

Some ideas that could be explored in the future:

-

After design mentoring, we also thought of getting form information in form of a chat but that might lengthen the onboarding process.

-

While exploring the onboarding form process, getting input through voice was also an idea that we wanted to explore.

Final Showcase Presentation

The final presentation was done remotely on Zoom. During the final public showcase, we had an audience from different backgrounds like experts from Facebook, Razorpay, Parallel Labs, Sahamati, D91 labs, etc, designers, policy experts, fintech experts, students, etc.

We had 7 mins to present our prototype. While we were presenting, the audience was free to give their feedback/ suggestions in a comment section on Zoom.

Feedback during the presentation

What happens next?

The next steps will be to refine all prototypes by team D91 and to test them with users. This a part of a design toolkit around consented data sharing and data portability with the upcoming public infrastructure Account Aggregators as the main theme in focus. The toolkit will host resources and assets around designing better user experiences for data sharing and data portability.

Reflection

The remote design jam was a great experience overall. During this span of two-week, we got to interact with various industry experts and mentored and guided by the best.

The design challenge statement was given to us very clearly and precisely. All the steps and work required from us clearly mentioned in a written form with visuals. This was the first time understand the importance of articulating the design brief concisely. As this was a remote jam everything was happening virtually and we use creative tools like Miro, Figma, Google docs, etc to design. Personally, this was a very new experience for me to collaborate and design virtually. I learned about team dynamics and the art of clear communication to make sure your thoughts are aligning with your teammates.

The jam was overlapping with our studio classes so we learned about managing things simultaneously and balancing our time and work efficiently.

The group design mentoring and personal policy mentoring was a great opportunity to clarify our doubts and design more holistically. Also, the design framework provided to us helps us in guiding our design process. Though there was some critical discussion regarding the selection of ideas, our facilitators helped us in navigating through them and reach the appropriate conclusion.

The concept of Account Aggregator was completely new for us. Getting familiar with the concept, empathising with the user via persona, mapping his user journey and finding paint points through them was our logical steps in designing the right solution. In the end, presenting in front of experts and also getting to know other teams approach was very insightful and helpful.

The goal of the project is big and we are grateful to team D91, TTC Labs, Parallel Studio, Sahamati, etc for giving us this opportunity and be a part of the next financial revolution.

Team: Mrunali Ogriwala, Rajath TS, Sakshi Meena and Sauraj Babu